reit tax advantages canada

For example if you paid a REIT share 10 and the REIT has a ROC of 050 per share your new cost is 950 per shares. If it pays a dividend to shareholders thats after-tax.

Reits Canada Still Offers Tax Advantages For These Investments

The average dividend yield.

. And we continue to believe that low interest rates and government-stimulus spending may spur inflation over the next few years. When a typical corporation makes money it has to pay taxes on its profits. In Canada a REIT is not taxed on income and gains from its property rental business.

With the ability to defer taxation for an undefined period at my option it allows more capital to stay invested earning a. They can provide a hedge against inflation for example. Your REIT Income Only Gets Taxed Once.

As a result of the Tax Cuts and Jobs Act TCJA REIT investing has been further enhanced. Taking advantage of the REIT opportunity now and into the future. Introduction of a like-kind exchange or a similar vehicle might provide a lift to the industry and create growth opportunities.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. In most cases the investors are taxed on regular income although some distributions can be. The energy sector in Canada is vast comprising a large portion of the TSX.

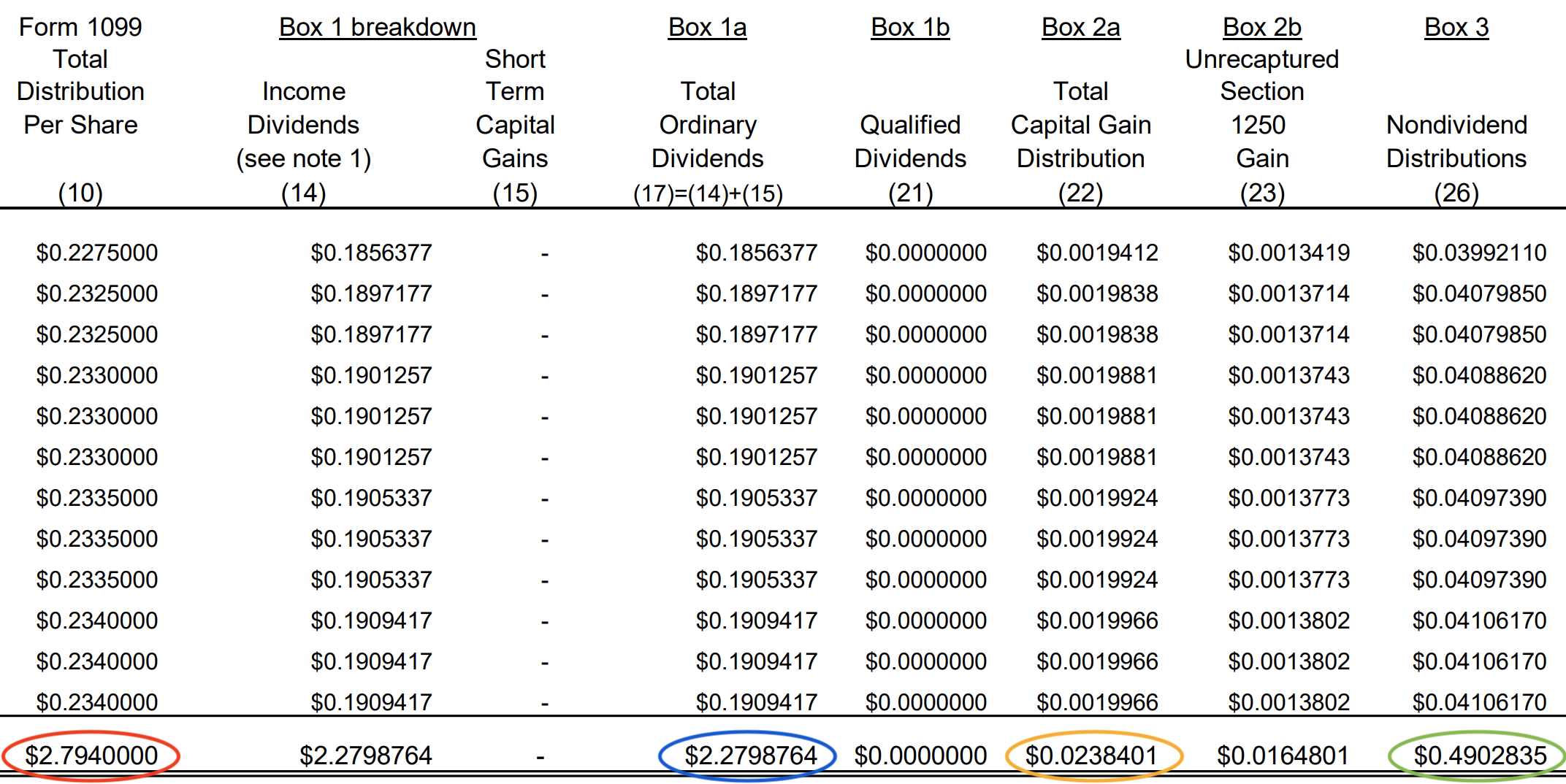

They dont have to pay taxes on. The big advantage however is the 38 chunk that is tax deferred. REITs also pass along tax advantages to unit holders such as expenses and depreciation.

There is no immediate tax to pay on it as it simply reduces the cost of the share. When a REIT makes a capital gains distribution 20 maximum tax rate plus the 38 surtax or a return of capital distribution. Since their introduction to Canada REITs have become an attractive onshore tax-efficient vehicle for investors.

When the REIT distributes its profits to its unitholders it does not pay any taxes on corporate profits. The fact that they act as flow-through vehicles with no tax at the trust level makes them particularly attractive for tax-deferred plans. Home Investing REIT Tax Rule Changes.

1 pre-tax income flows through to investors 2 investors get favourable tax treatment on the income and 3 a com-ponent of the tax obligation is deferred until the units are sold. Growth investors While the first two priorities are stability and income distribution Canadian REITs. Dividend distributions from the REIT are taxed at a rate of 30.

All of this will be broken out on your annual. Income trust tax exemption just one advantage of investing in REITs Canada REITs can add to your portfolio in a number of other ways. It requires a good stock tracking system.

Some benefits of REITs include. On the subject of REIT taxation an article in the Financial Post states. The competitive advantages are long-term indexed leases and stable.

Investors seeking tax benefits REITs offer three major tax benefits. What Are Tax Advantages Of Reits. Capital gains taxes in Canada may inhibit REIT growth by preventing trusts from efficiently recycling capital putting REITs here at a disadvantage.

Many REITs have taken advantage of. The plans would receive pre-tax income compared with ownership of real estate corporation shares that provide after-tax dividends. One significant advantage of investing in a private REIT is its correlation has been historically low to the marketsthe price of private REIT units is solely based on the actual appraised value of the real estate holdings which generally translates to a lack of fluctuation in response to public market volatility.

And like most businesses real estate investing has several tax advantages. Nothing eats away at returns like taxes. Taxation of Canadian income trusts is special in Canada.

The majority of distributions are taxable as ordinary income although some distributions qualify as tax-free returns of capital. REITs are qualified investments for RRSPs RRIFs and TFSAs. The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors 1 A report from Grant Thornton LLP agrees.

When a REIT distributes dividends received from a taxable REIT subsidiary or other corporation 20 maximum tax rate plus the 38 surtax. For many investors the main attraction of REITs has been their dividend yield. Income trusts in Canada are treated differently from other types of businesses.

Investors can deduct mortgage interest just like any other sort of investment loan you could take out a loan to invest in REIT and could deduct that interest too. REITs like Equity Residential are required to pay at least 90 of their disposable income to the unitholders. REITs do not pay corporate taxes when they distribute their income to their unitholders.

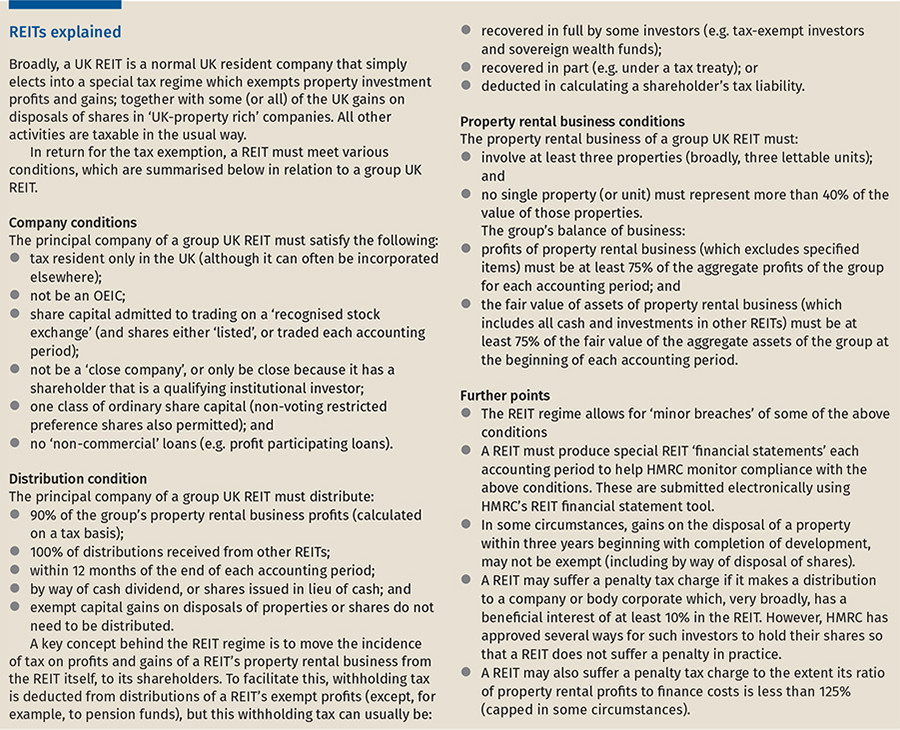

Preferred shares in addition to five. ROC is referred to as a reduction in adjusted cost base or ACB. Instead shareholders are taxed on a REITs property income when it is distributed and some investors may be exempt from tax.

Dividends paid to shareholders by REITs are deductible from corporate income tax. REITs offer certain tax advantages to encourage this investment. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

How is the REITs market evolving in Canada. When the individual taxpayer is subject to a lower scheduled income tax rate. The preferential treatment of shareholders may then be extended to US.

REIT Tax Benefits No.

Ctcar Is Excited To Partner With Todd Kuhlmann Ccim On A 2 Day Financial Analysis C Commercial Real Estate Investing Commercial Real Estate Financial Analysis

Pin By Leonard Usayi On Real Estate Investor Real Estate Investor House Styles Real Estate

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Cef Strategies Municipal Bond Cefs Back On Sale Bond Strategies Finance Organization

Secret Tax Hacks Money Management Investment Quotes Real Estate Investor

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

How Income Tax Rules Help Reit Investors Earn More In Long Term

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

Taxes What Realty Income Corp Shareholders Need To Know The Motley Fool

Why Reit Dividends Are A Game Changer For Investors The Motley Fool

Reit Taxation A Canadian Guide

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits Canada Still Offers Tax Advantages For These Investments

Taxation Of Reits Ringing In The Changes

Cef Strategies Municipal Bond Cefs Back On Sale Bond Strategies Finance Organization

Ctcar Is Excited To Partner With Todd Kuhlmann Ccim On A 2 Day Financial Analysis C Commercial Real Estate Investing Commercial Real Estate Financial Analysis